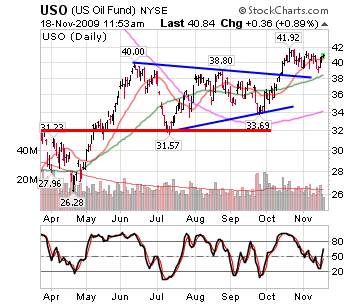

Although much of the recent focus on assets benefiting from a declining dollar have centered on precious metals, another asset that has been benefiting is oil. Oil, as measured by the United States Oil Fund (NYSE:USO) ETF, is quietly trading at prices unseen since last December. While this is still a long way from USO's 2008 summer highs in the low $100s, it is starting to get a boost, with long-term interest rates at historically low levels.

For many there is fear as to what will happen when the Fed eventually raises rates, and this possibility is probably starting to find its way into assets like this USO ETF. The chart for USO shows that it was able to clear a base it formed from May through October, and it has been consolidating from this breakout in a bullish fashion while forming a flag pattern. It will be interesting to see if it can follow through with a move above the $41-42 level.

|

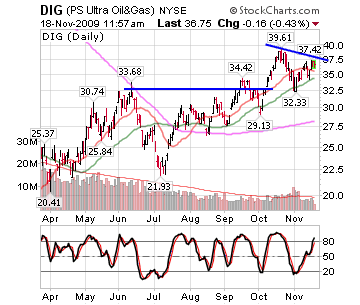

One way to take advantage of rising oil is with a basket of oil service stocks. The Pro Shares Ultra Oil and Gas Index ETF (NYSE:DIG) measures the performance of the energy sector and components which include oil drilling equipment and services, coal, oil companies, pipelines, and gas producers and service companies. This ETF had been trading in a base for several months before finally clearing its resistance in October. It quickly retested its base support into early November, and appears to have held the area as support. The levels to watch in the near term are the recent highs near $39 and the recent low near $32.

|

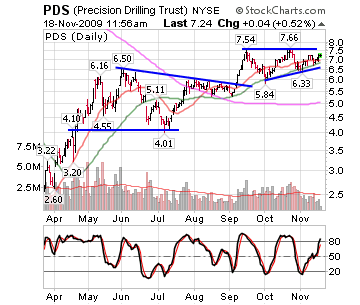

One individual stock that may be worth an investment if the sector continues performing well is Precision Drilling Trust (NYSE:PDS). PDS had been forming a large cup-and-handle type base over the past several months and it finally made a push above resistance in September. It has been consolidating above the prior resistance area since the breakout and could be close to a breakout above this resistance. The $7.60 area deserves attention, as it has contained the past two rally attempts.

|

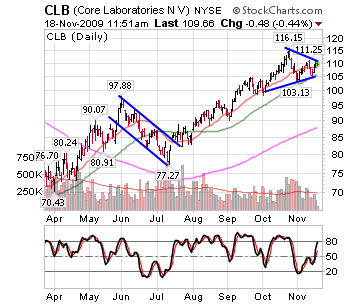

Another individual stock that could benefit from continued strength in the oil sector group is Core Labs NV (NYSE:CLB). CLB has been in a steady rising trend since bottoming in December 2008. It did experience a one-month correction after rallying to a high in early June, but it was able to break the June high a few months later in September. It is currently consolidating in a triangle base, a very good signal for you to consider investing in this stock because this is often a continuation pattern.

|

What All This Means For You

With oil at fresh several month highs, it is possible that momentum can carry the price farther than most think. If the dollar continues to weaken, which we believe it will, or the economy shows any signs of strengthening, which it already is, this could trigger a sharp rise in oil prices. While these ETF's and stocks are still in a longer term bear market, they have good prospects for a corrective move higher in the short to medium term, and even long term trend change around the corner. Rallies in down markets can often produce sharp gains quickly, so as an investor you should be open to all opportunities as long as they adhere to your risk tolerance, and time-frame.

No comments:

Post a Comment

We would love for you to express your opinion, or ask us a question on our blog!